Learning the Fundamentals: Crucial Excel Formulas for All

Excel can greatly improve your capacity to organise and analyse data, whether you're a corporate professional, student, or someone trying to handle personal projects. Leveraging Excel's full capabilities requires an understanding of its fundamental formulae.1. SUM: Adding Values

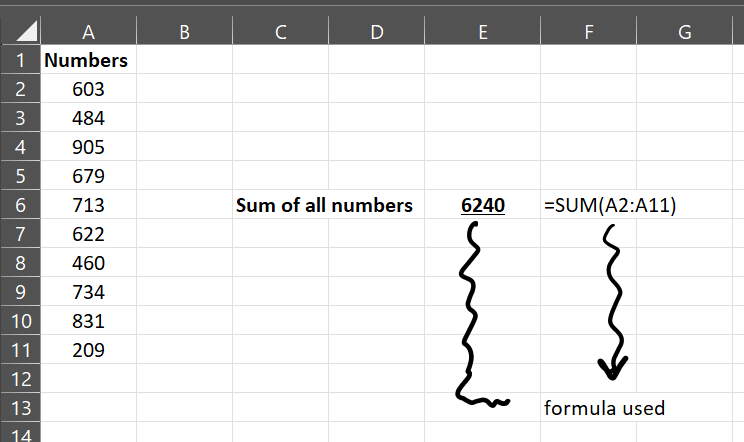

The SUM function is one of the most frequently used formulas in Excel. It allows you to quickly add up a series of numbers.

Formula/Syntax: =SUM(number1, [number2], ...)

Example: =SUM(A2:A11) adds all the values from cells A2 to A11.

2. AVERAGE: Calculating the Mean

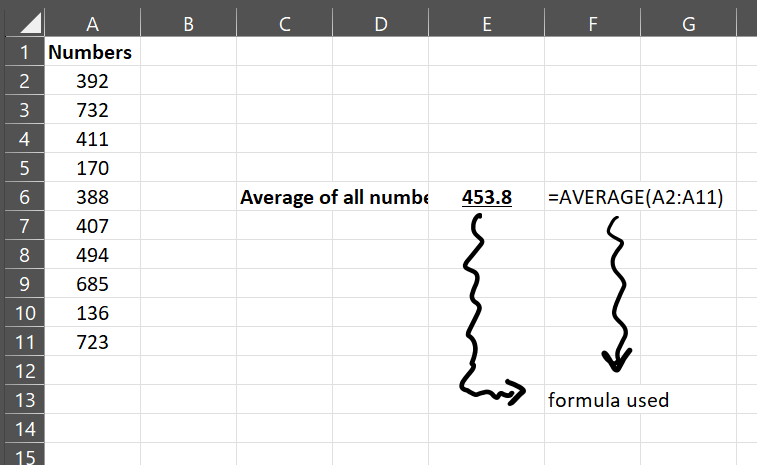

Use the AVERAGE formula to find the mean of a series of numbers. This is particularly useful in data analysis to get a central value.

Formula/Syntax: =AVERAGE(number1, [number2], ...)

Example: =AVERAGE(A2:A11) calculates the average of values in cells A2 through A11

3. COUNT: Counting Cells with Numbers

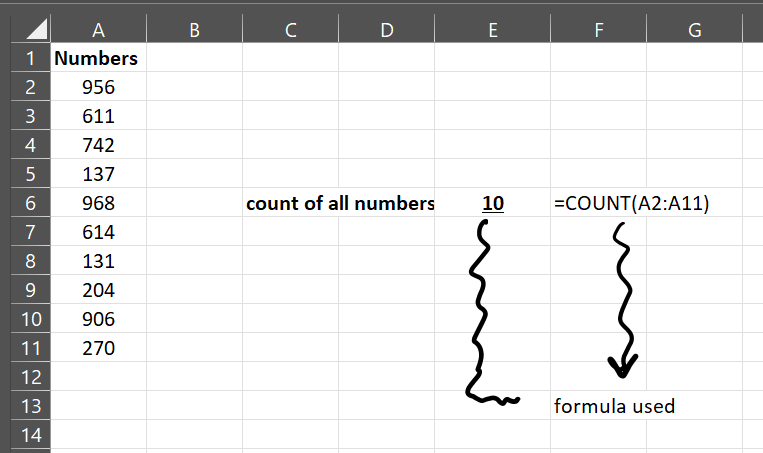

The COUNT function helps you count cells that contain numerical values in a range.

Formula/Syntax: =COUNT(value1, [value2], ...)

Example: =COUNT(A2:A11) counts the number of cells with numbers in the range A2 to A11.

4. IF: Conditional Logic

The IF function is incredibly versatile and allows you to perform logical comparisons between a value and what you expect by testing for a condition and returning one value if true, and another value if false.

Formula/Syntax: =IF(logical_test, value_if_true, value_if_false)

Example: =IF(A2>500, "true", "false") returns "true" if A2 is greater than 500, otherwise "False".

Comments

Post a Comment